With a 33.2 percent growth in export value in 2021, textile suppliers from turkey sector, the world’s fifth-largest, set a new record high. Nearly eighty-five percent of the more than two hundred nations and regions to which the industry ships goods have seen export increases. During the month of December, exports hit a record high of $1.2 billion, up 18.2% from the same month the year before. The numbers were up 2.1% from the previous month and accounted for 5.4% of Turkey’s total exports.

Exports of general goods from suppliers from turkey climbed by 24.9% to a total value of $22.3 billion in December 2021, while exports of industrial products increased by 27.6% to a total value of $16.9 billion. The Central Bank of the Republic of Turkey recently released a study showing that the manufacturing sector’s annual average capacity utilization rate was 76.6%. At the same time, the percentage of available manufacturing capacity used fell by 1.4% from November 2021 to December 2020, but rose by 5% from December 2020 to December 2021.

In the first three quarters of 2021, the European Union (EU) (consisting of 27 nations) was the primary destination for shipments of textiles and raw materials. There was a 33.8% increase in the value of exports to the European Union, reaching a total of $12.91 billion, from January to December of this year. Turkey’s exports to the Former Eastern Bloc Countries climbed by 30.2% from January to December of 2021, reaching $1.4 billion. This group represents the second largest market for Turkish textiles and raw materials exports. There was a 23.5% increase in the volume of exports to the EU countries from January to December of 2021, with 2.9 million tons shipped there.

In 2022, the top textile exporting nations will be Italy (with a value of $1.1 billion, up 52.5%), Germany (with a value of $1 billion, up 11.2%), and the United States (with a value of $840 million, up 33.7%). The European Union (EU) countries accounted for almost 6 billion dollars in 2021, a 33.8% rise from the previous year and the clothing suppliers from turkey largest export market. According to Ahmet ksüz, by 2022, EU exports might be worth as much as $7.5 billion. Belarus saw a 75% increase, Spain a 61% increase, and Egypt a 59.9% increase in exports. All of the top 10 destinations for Turkish textile and raw material exports saw growth during this time.

Exports in the Turkish textile and raw materials sector reached 2.9 million tons in the first twelve months of 2021, up 23.5% from the corresponding period in 2020. China, the sector’s eighth largest export market, saw the highest percentage gain in exports based on quantity among the top ten countries during this time. The value of textile and raw material exports to China over this time period climbed by 152.2%, to 94 thousand tons.

With exports reaching $12.9 billion, Turkey’s textile industry reached an all-time high.

There was a 67.6% increase in yarn exports, a 25.8% increase in woven fabric exports, and a 14.5% reduction in technical textile exports from January to December of 2021. The export levels of both home textiles (value $2.3 billion) and knitted fabrics (worth $2.1 billion) in 2021 were the highest they had ever been. The European Union is our largest export market, and we have a share of more than 10% in home textile imports there. In terms of knitted fabric, we are the largest supplier in the European Union. Among the EU’s top imports, knitted fabrics make up 42.4% of those from Turkey. When looking ahead to 2022, we predict further prosperity in the knitted fabric and home textiles markets. And in 2022, we’ll start making changes to our exports of woven fabric and technical textiles.

The textile and apparel sector is a major contributor to Turkey’s GDP. Industry in Turkey has long been referred to as the “locomotive” of the country’s economy. The abolition of EU and US quotas in January caused a drop in Turkey’s textile and clothing exports, but recent months have seen a recovery.

Turkey’s current textile sector may trace its roots back to the country’s efforts to industrialize in the 1960s and 1970s. These businesses started off as garage-sized operations. However, it grew rapidly during the 1970s and started shipping products abroad. These days, Turkey is a major supplier of textiles and apparel.

Clothing suppliers from turkey have started moving their operations to Eastern Europe and Central Asia. Although they had great success in the 1980s and early 1990s, Turkish textile and clothing firms have been struggling more and more in the last three years.

After a decades-long quota system prohibits textile exports from China on January 1, 2005, the WTO predicts that the Asian superpower would produce more than half of the world’s textiles by the end of the third year, up from 17% in 2003.

Concerns about a global employment crisis have arisen as a result of the termination of the quota regime; in Turkey, for example, where the textile and garment industry is worth about $20 billion annually, this is especially concerning.

So, it’s important to learn about clothing suppliers from turkey, including its strengths and weaknesses in the global market.

In the previous two decades, the textile and clothing industry in Turkey has played a crucial part in the country’s industrialization and market orientation. In the 1980s, export income from this leading sector of the global economy made a sizable contribution to GDP. Although the Turkish economy as a whole grew at a more modest rate of 5.2% per year during the 1990s, the textile industry was one of the fastest growing sectors, expanding at an average of 12.2% annually. More than US$ 50 billion has been spent in the sector in the last 5-10 years, bringing the total investment to over US$ 150 billion.

Turkey’s textile industry, which began in modest workshops in the 1960s, has expanded swiftly and made the country a major player on the international stage.

About 25% of the roughly 44,000 businesses in the industry that are controlled by the private sector are engaged in exporting. In contrast to the large-scale corporations that have historically handled the technology-intensive textile production, the garment sector is dominated by small and medium-sized businesses (80%). Among today’s 500 largest enterprises in Turkey, over 20% are engaged in textiles and garment production.

The rapid expansion of the sector in the previous two decades can be attributed in large part to favorable macroeconomic conditions, including a liberalized economic environment and export-led policies.

Over $20 billion in annual revenue is generated by the clothing suppliers from turkey. According to projections, roughly 4 million people are employed in the industry (2.5 million employed directly and a further 1.5 million indirectly through the sub-sectors). Approximately half a million people are employed in the industry, but they are not counted in the official statistics.

Sixty percent of the garment industry’s output is exported. Particularly high utilization rates of around 75% are seen in exporting factories.

Woolen textiles, carpets, synthetic filament and fiber, polyester and polyamide filament, and all three are among Turkey’s top 10 exports. Turkey accounts for 15% of Western Europe’s capacity in synthetics production, despite being home to Europe’s third-largest polyester producer (a joint venture between Turkey and the United States).

The Turkish economy benefits greatly from the textile and garment sector. The textile and garment sector, for instance, is responsible for:

. 10% in GNP

. Forty percent of manufacturing output

thirty percent of the workforce is directly involved in manufacturing

35% of total export revenue

The textile and garment industry adds more than $20 billion to the economy every year. Earnings from exports are particularly crucial, with the industry accounting for between 33 and 39 percent of all exports since 1990.

Turkey’s textile and clothing exports to the European Union account for over 65% of the country’s total textile and apparel exports. As of 2003, Turkey’s textile and clothing imports to the European Union (EU) accounted for 8.2% and 4.8%, respectively, of the EU’s total textile and apparel imports.

From 1980 to 2003, the average annual growth rate of textile and apparel exports was 14.6%. Exports in this sector grew faster than those of Turkey as a whole and the textile and apparel industry as a whole up until the middle of the 1990s. The industry’s share of global exports in 2003 was 32.6%, with a total export value of US$ 15.1 billion. The value of exports increased by 23% from 2002 to 2003. Since 1986, exports of garments have made up a larger and larger percentage of the total, which is indicative of an increase in the production of products with higher added value.

Next to the European Union, the United States is a potentially massive market. With a 1.9% stake in the clothing market and a 2.9% share in the textile market, Turkey is the 19th and 9th largest exporters to the United States. New markets include those in North Africa (Tunisia, Egypt, and Algeria), the Middle East (Syria, Israel, and Saudi Arabia), Eastern Europe (Romania, Bulgaria, Poland, and Hungary), and the Commonwealth of Independent States (CIS). Currently, only the United States and Canada impose quotas on the industry. Even before the economic collapse of August 1998, the Russian Federation was a significant market for Turkish textiles and clothing. In 1997, it was the third largest market for clothes and the ninth for textiles. Russia’s enormous consumption potential will emerge in the next years, making it an attractive market for the textile and clothing industries, especially in light of recent advances toward closer integration into the global economy and WTO membership chances.

Turkey’s abundance of high-quality cotton makes it a desirable source of raw materials for the textile sector. Turkey has always been a major player in the textile and garment industries thanks to its access to cotton. Averaging between 800,000 and 900,000 tons per year, Turkey is first in Europe and sixth in the world in cotton output.

year. Southeastern Anatolian Project (GAP) irrigation projects are planned to be completed by 2005, doubling present cotton production.

Turkey grew 893 thousand metric tons of cotton during the 2003–2004 season. Only about 30% of the world’s cotton crop is made up of high-quality long-staple cotton. The textile industry, which relies on cotton as a primary raw material, benefits from the success of the cotton business.

Exports of cotton yarn primarily go to Italy, Portugal, Greece, and Belgium, whereas exports of cotton fabric primarily go to the United Kingdom, Italy, the United States of America, and Belgium. Cotton used to be an export earner for Turkey, but the country has been a net importer since 1992 due to constant internal demand exceeding supply. In addition to cotton, Turkey also excels at producing synthetic fibers, wool, and mohair. In terms of global production, Turkey is ranked ninth for synthetic fiber, eighth for wool, and third for mohair.

Turkey’s home textile industry has also increased in output and exports, just like the country’s main textile sector. The rising demand for both domestic and international home textiles has led to a steady increase in production in recent years. The production and exports of home textiles from Turkey have risen in recent years. Turkey is a major producer of household textiles. These may be ranked according to their export values as follows: bed linens, bedspreads, table linens, towels, bathrobes, voiles, curtains, lace, interior blinds, curtain or bed valances, blankets, cushions, pillows, quilts, eiderdowns.

Aside from the major corporations, there are also many small and medium-sized businesses (SMBs) operating in the home textiles industry across the United States. The home textiles sector is a significant part of Turkey’s economy, as it contributes 3.2% of the country’s total exports and is a sub-sector of the textile industry. Turkey’s most lucrative export markets for home textiles are in European countries. Turkey’s primary export customers for home textiles are the European Union, specifically Germany, the United Kingdom, France, the United States, the Netherlands, and the Russian Federation. The importance of emerging markets like Poland, Hungary, Romania, and the Commonwealth of Independent States (CIS) is rising rapidly.

Because of advances in technology like CAD and CAM, as well as an increase in the number of qualified workers, textile and clothing products made in Turkey have earned a solid reputation in international markets.

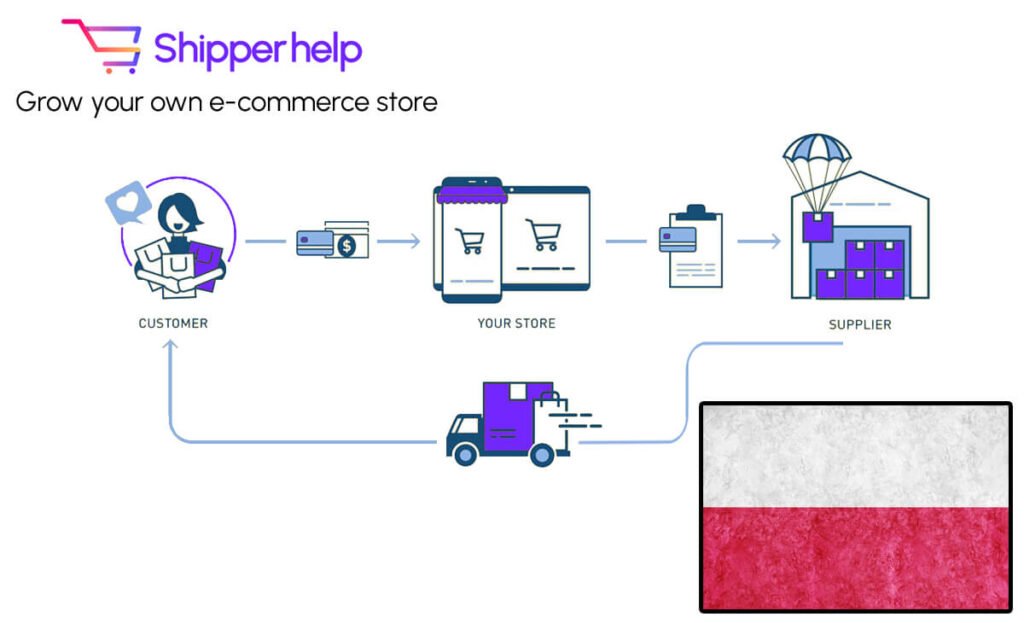

Dropshipping from Turkey suppliers might be challenging for those who aren’t sure how to get started in the industry. Our present essay will go into detail on this topic, as well as other drop shipping related topics, pertaining to Turkey.

A dropship vendor is one that transports goods directly from the manufacturer to the end user. That is to say, the retailer makes the purchase from the distributor or wholesaler and then delivers it to the end user. Therefore, this retailer has no use for warehouse space.

Dropshipping is primarily concerned with delivering products to clients, therefore if you are worried about the legality of working in drop shipping in Turkey, you need not.

Therefore, there is no valid reason to avoid conducting business as usual and using mediators to resolve disputes. Without restrictions based on location or policy, dropshipping can be practiced with virtually any supplier and delivered to any customer.

A dropshipper’s primary responsibility is to provide the customer with a competitive price. Besides making sure that suppliers provide products in a timely and satisfactory fashion to customers.

Here are some of the most important factors that contribute to dropshipping’s lucrative nature:

Market research indicates that, in comparison to other European countries, Turkey has a sizable consumer base. While the typical European country has a population of about 50 million people, Turkey is home to a much younger 80 million individuals. In addition, the population is expected to increase to 93 million by 2050, while it is expected to decline in most European countries. Therefore, running a dropshipping business in Turkey is a lucrative endeavor.

One of the first countries to adopt modern technology, Turkey now has a mobile phone penetration rate of around 94%; the country also ranks well in the use of technology in retail. The number of Turks who shop online far exceeds the number who shop at traditional malls.

The rapid growth of e-commerce in Turkey is undeniable evidence that online purchasing will soon play a significant role in the daily lives of Turks. Many businesses have consequently moved their operations online.

To prevent getting lost and stumbling into future troubles in any business, it is essential to know the basic procedures to get started. There are essentially two things you need to do to get started in dropshipping:

Product prices: which are cheap, so that customers can still make a profit despite factoring in all the associated costs of making a purchase.

As the world’s manufacturing hub, China provides quick access to a large variety of name-brand and private-label products, making it simple to tailor your inventory to current demand.

You may now shop on Turkish websites even if you’re not physically in Turkey, right? We’ve written an essay that will walk you through the steps of buying anything in Turkey. You can place an order with a Turkish retailer and have the goods delivered to your doorstep.

The industry is cognizant of the demand for healthier and more ecologically friendly products on global marketplaces and is making efforts to conform to these shifts through legislative and technical requirements.

Nonetheless, in a market crowded with new entrants, it is challenging to maintain a leading position. As a result, the focus of manufacturers has turned to creating value-added goods and new brands. As it stands, 30% of Turkey’s manufacturers are selling their own brands and designs abroad.

According to recent research, emerging countries will boost their manufacturing capacity to satisfy rising demand in the textile industry, while developed countries will see their share of global textile production decrease. By 2005, it’s anticipated that the developing world would have achieved more textile self-sufficiency. Even though US textile consumption is predicted to expand by 200% by 2005, the country’s ability to produce its own textiles is predicted to fall by 32%.

Turkey’s textile sector aspires to enter a period in which it is known for quality trademarks and a product is priced for the Made in Turkey sign, thanks to the country’s capacity to adapt to European norms and laws pertaining to environment, health, quality, and safety.

Finding reliable dropshipping suppliers in Poland is a critical step for any online business looking to leverage the growing e-commerce sector in Europe. Suppliers from Poland can offer several advantages, including high-quality products, strategic geographical location for shipping within the EU, and potentially lower operational costs. To embark on this journey, it’s crucial to approach the search methodically, prioritizing reliability, communication, and product quality. Here’s a comprehensive guide to navigating this process effectively.

1. Start with Thorough Research: Begin your quest by conducting extensive online research. Utilize global trade platforms such as Alibaba and Global Sources, but also consider European-centric platforms like EuroPages and Wer Liefert Was. These platforms often list detailed profiles of suppliers, including their product ranges, minimum order quantities, and customer reviews. Keywords like “suppliers from Poland” or “Polish dropshipping suppliers” can help narrow down your search. Additionally, exploring niche-specific forums and social media groups can unveil valuable insights and recommendations from experienced dropshippers.

2. Evaluate the Supplier’s Reliability: Once you’ve compiled a list of potential suppliers, assess their reliability by examining their business history, customer testimonials, and any certifications or memberships in trade associations. Contacting the Polish Chamber of Commerce or similar organizations can provide further validation of a supplier’s credibility. Reliable suppliers are typically transparent about their business practices, production capabilities, and shipping policies.

3. Prioritize Communication: Effective communication is paramount in any dropshipping partnership. Assess the supplier’s responsiveness, proficiency in English (or your preferred language), and willingness to provide detailed product information and support. A supplier’s responsiveness to inquiries and issues is a good indicator of their commitment to customer service.

4. Order Samples: Before finalizing any agreements, order samples of the products you intend to sell. This step is crucial for assessing the quality of the products firsthand and understanding the shipping times and packaging quality. High-quality products and efficient logistics are foundational for building customer trust and satisfaction in your dropshipping business.

5. Understand the Terms and Conditions: Clear understanding of the supplier’s terms and conditions, including payment terms, return policies, and warranty arrangements, is essential. This understanding can help prevent potential disputes and ensure a smooth operational process. Negotiate terms that align with your business model and customer service standards.

6. Explore Integration Capabilities: For efficiency and scalability, look for suppliers who can integrate their systems with your e-commerce platform. This integration can streamline order processing, inventory management, and tracking, thereby enhancing the overall efficiency of your dropshipping business. Suppliers equipped with advanced technological capabilities are generally more adaptable and capable of supporting your business as it grows.

7. Plan Visits if Possible: Although not always feasible, visiting a supplier in Poland can provide invaluable insights into their operation, product quality, and business ethics. Personal interactions can strengthen business relationships and lead to better terms and cooperation.

8. Leverage Local Expertise: Consider partnering with local business consultants or agents who specialize in the Polish market. These professionals can provide insider knowledge, facilitate introductions, and help navigate the legal and cultural nuances of doing business in Poland.

9. Monitor and Adapt: Once you’ve established a relationship with a supplier, continuously monitor the partnership’s effectiveness. Be prepared to adapt your strategy based on customer feedback, product performance, and evolving market trends. A successful dropshipping business is dynamic, responding promptly to opportunities and challenges.

Conclusion:

Finding reliable suppliers from Poland for your dropshipping business requires diligence, strategic planning, and a commitment to quality. By following these steps, you can establish a robust supply chain that supports your business goals, enhances customer satisfaction, and positions your online store for success in the competitive e-commerce landscape. Remember, the right supplier is not just a vendor but a partner in your business’s growth and scalability.

Partnering with suppliers from Poland for your dropshipping business presents a plethora of advantages that can significantly enhance your store’s value proposition, streamline operations, and bolster your market position. Poland, with its strategic location in Europe, advanced manufacturing infrastructure, and growing e-commerce ecosystem, offers a unique blend of benefits for dropshipping entrepreneurs aiming to scale their businesses efficiently and effectively.

Poland’s central location in Europe is its most pronounced benefit, providing unparalleled access to a vast consumer market. This geographic advantage facilitates shorter shipping times across the European Union, which is a critical factor in customer satisfaction and retention. Faster delivery times not only enhance the customer experience but also give your store a competitive edge over businesses sourcing from suppliers outside of Europe.

Polish manufacturers are renowned for their high-quality products, which span a diverse range of categories including electronics, fashion, beauty products, and more. By partnering with suppliers from Poland, your dropshipping store can offer products that meet or exceed EU standards, ensuring customer satisfaction and repeat business. Furthermore, the cost of manufacturing in Poland remains relatively low compared to other EU countries, allowing you to enjoy competitive pricing without compromising on quality. This price-quality balance is key to maximizing profits while building a reputable brand.

Poland boasts a skilled workforce and advanced manufacturing capabilities, with a strong focus on innovation and quality assurance. This ensures that products sourced from Poland are made using the latest technologies and adhere to strict quality controls. For dropshipping businesses, this means access to a wide array of products that are not only in demand but also differentiate your store with their quality and innovation.

The business environment in Poland is conducive to foreign investment and trade, thanks to its stable economy, EU membership, and supportive trade policies. The ease of doing business with Polish suppliers is further facilitated by the widespread use of English for communication, simplifying negotiations and day-to-day operations. Additionally, Poland’s alignment with EU trade regulations ensures a seamless and transparent process for importing goods, reducing bureaucratic hurdles and facilitating a smoother supply chain.

Partnering with local suppliers provides valuable insights into the European market’s preferences and trends. Polish suppliers, being familiar with the local and regional market dynamics, can offer guidance on product selection, branding, and marketing strategies that resonate with European consumers. This local expertise can be instrumental in tailoring your product offerings and marketing campaigns to meet the specific tastes and expectations of your target market, enhancing your store’s appeal and profitability.

As consumers become increasingly conscious of sustainability and ethical practices, sourcing from Poland can align your business with these values. Polish suppliers often adhere to sustainable manufacturing processes and ethical labor practices, reflecting positively on your brand’s image and attracting a segment of the market willing to pay a premium for ethically sourced products.

Suppliers from Poland are known for their flexibility in order processing and scalability, accommodating both small and large orders efficiently. This flexibility allows dropshipping businesses to test new products without significant upfront investment and scale up quickly based on demand. Furthermore, the close proximity and efficient logistics within Europe facilitate restocking and inventory management, enabling you to adapt swiftly to market changes and consumer trends.

In conclusion, partnering with suppliers from Poland presents a strategic advantage for dropshipping businesses looking to offer high-quality products, enjoy competitive pricing, and benefit from shorter shipping times within Europe. The combination of Poland’s manufacturing excellence, strategic location, and favorable business environment makes it an attractive sourcing destination that can significantly contribute to the success and scalability of your dropshipping business. By leveraging these benefits, you can enhance customer satisfaction, differentiate your brand, and position your business for long-term growth in the competitive e-commerce landscape.

Improving delivery times is a pivotal factor in achieving customer satisfaction and loyalty in the e-commerce industry. Partnering with suppliers from Poland can indeed offer significant advantages in terms of logistics and shipping efficiency, especially for dropshipping stores targeting the European market. Here’s how:

Poland’s central location in Europe is its most strategic logistic advantage. This centrality ensures shorter transit times for goods across the continent, making it possible to offer faster delivery to customers in various European countries. Compared to suppliers located in Asia or North America, Polish suppliers can significantly reduce the time it takes for products to reach your customers, enhancing the overall shopping experience on your platform.

Poland has heavily invested in its transportation and logistics infrastructure over the years, boasting an extensive network of roads, railways, and modern freight facilities. This development ensures smooth and efficient transport of goods both within Poland and to neighboring countries. For dropshipping businesses, this means reliable and timely deliveries, minimizing delays and disruptions that could negatively impact customer satisfaction.

Poland is home to several major logistics hubs that serve as key distribution points for goods throughout Europe. By dropshipping from suppliers located near these hubs, your e-commerce store can benefit from streamlined logistics, including faster order processing and dispatch times. This proximity allows for more efficient handling of orders, enabling next-day or two-day delivery options for customers in many European regions, a service level that can significantly boost your store’s competitive edge.

As a member of the European Union, Poland enjoys the benefits of the EU Customs Union, which simplifies customs procedures and eliminates duties on goods moving between member states. This seamless movement of goods across EU borders without the need for customs checks significantly speeds up delivery times, ensuring that your customers receive their orders faster. This aspect is particularly beneficial for dropshipping stores, as it reduces the complexities and delays often associated with international shipping.

The growing e-commerce sector in Poland has led to the emergence of advanced dropshipping and fulfillment services designed to optimize delivery times. Many Polish suppliers and third-party logistics providers offer integrated solutions, including stock management, order processing, and expedited shipping options. Leveraging these services allows dropshipping stores to minimize the time between order placement and delivery, enhancing customer satisfaction and encouraging repeat business.

Suppliers from Poland are generally well-versed in the demands of the e-commerce market and understand the importance of quick turnarounds. This responsiveness means that dropshipping stores can count on their Polish partners to promptly handle orders, reducing lead times from order placement to dispatch. Additionally, the ability to work closely with suppliers on inventory management and forecasting can further reduce delays, ensuring that popular items are always available for swift shipping.

In summary, dropshipping from Poland suppliers offers a robust solution to one of the most critical challenges faced by e-commerce stores in Europe: reducing delivery times. The strategic geographic location, advanced logistics infrastructure, and the benefits of EU membership position Poland as an ideal sourcing destination for dropshipping businesses aiming to enhance their service levels. By capitalizing on these advantages, your e-commerce store can not only improve delivery times but also elevate the overall customer experience, setting your brand apart in the highly competitive online retail space.

Choosing the right product types is crucial for maximizing profits in a dropshipping business, especially when sourcing from Poland. Poland’s diverse manufacturing sector, strategic location in Europe, and reputation for quality offer dropshippers unique opportunities to carve out profitable niches. Here’s an overview of the best types of products to dropship from Poland for maximizing profits, considering market demand, quality, and logistical advantages.

Poland is renowned for its artisanal and handcrafted products, including ceramics, glassware, linen, and wooden items. These products are highly valued for their quality, craftsmanship, and cultural significance, appealing to consumers looking for unique, authentic items for their homes or as gifts. Dropshipping these handcrafted goods can attract a premium customer base willing to pay higher prices for artisanal quality, thereby increasing your profit margins.

The Polish beauty industry has seen significant growth, with a focus on natural and organic products. Polish beauty brands are celebrated for their high-quality ingredients, effectiveness, and eco-friendly practices. The global demand for clean beauty products is on the rise, making this a lucrative niche for dropshipping. By offering exclusive Polish beauty and personal care products, you can tap into this growing market segment and benefit from higher profit margins due to the premium nature of these goods.

Poland’s fashion industry, especially in segments like lingerie, activewear, and children’s clothing, is well-regarded for its quality, innovative designs, and competitive pricing. Dropshipping Polish fashion brands allows you to offer unique products that stand out in the crowded online apparel market. Given the fast-changing trends in fashion, the ability to quickly source and supply new styles from Poland can give your store a competitive edge, attracting fashion-forward customers and boosting profitability.

Poland’s furniture industry is one of the largest in Europe, known for its modern design, functionality, and durability. The country’s home decor segment also offers a range of products that blend traditional craftsmanship with contemporary aesthetics. Dropshipping furniture and home decor items from Poland can cater to consumers looking to furnish their homes with stylish, high-quality pieces. While the logistics of shipping larger items might seem challenging, the high demand and profit margins associated with furniture can make it a worthwhile niche.

Poland’s emerging tech industry produces a variety of innovative tech accessories and gadgets, including smart home devices, wearable tech, and eco-friendly electronic accessories. These products are increasingly popular among tech-savvy consumers looking for the latest innovations to enhance their digital lifestyle. Dropshipping these items can leverage Poland’s growing reputation as a hub for tech innovation, offering customers unique products not available elsewhere and securing higher profit margins through exclusivity.

The health and wellness sector in Poland includes a range of products such as dietary supplements, organic foods, and fitness equipment. With an increasing global focus on health and well-being, these products are in high demand. Polish suppliers often emphasize quality and natural ingredients, appealing to health-conscious consumers worldwide. Dropshipping these products can attract a dedicated customer base willing to invest in premium health and wellness solutions, driving up your profits.

Poland’s rich culinary traditions offer a variety of specialty foods and beverages that are hard to find elsewhere, including artisanal cheeses, craft beers, and organic honeys. These products cater to a niche market of food enthusiasts looking for authentic culinary experiences. Dropshipping Polish specialty foods and beverages can command higher prices due to their uniqueness and quality, appealing to consumers’ desire for gourmet products.

Conclusion

Maximizing profits through dropshipping from Poland involves selecting product types that leverage the country’s manufacturing strengths, cultural heritage, and innovation. By focusing on niches such as handcrafted goods, beauty products, fashion, home decor, tech gadgets, health and wellness items, and specialty foods, dropshippers can offer unique value to consumers and achieve higher profit margins. The key is to identify products that not only have a high demand but also allow for premium pricing due to their quality, uniqueness, or brand appeal.

Negotiating with suppliers from Poland for better dropshipping terms and conditions is a critical step in establishing a profitable and sustainable business model. Effective negotiation strategies can lead to improved profit margins, more favorable payment terms, and enhanced supply chain efficiency. Here’s a comprehensive guide to successfully negotiating with Polish suppliers, tailored to the unique context of dropshipping businesses.

Research Before Negotiation: Begin by thoroughly researching the Polish market, focusing on the specific industries and products relevant to your dropshipping business. Understanding the competitive landscape, average pricing, and quality standards in Poland will equip you with the knowledge needed to negotiate effectively.

Assess Supplier Capabilities: Evaluate potential suppliers based on their production capabilities, quality assurance processes, and flexibility in order fulfillment. This assessment will help you identify suppliers who are not only able to meet your current needs but can also scale with your business.

Establish Rapport: Building a strong relationship with your suppliers from Poland is crucial. Polish business culture values personal relationships and trust, so take the time to establish rapport before jumping into negotiations. This approach can lead to more open and collaborative discussions.

Communicate Your Business Goals: Clearly communicate your business goals and how you envision the supplier fitting into your business model. Highlighting the potential for a long-term partnership can make suppliers more open to negotiating terms that are favorable to both parties.

Prioritize Your Needs: Before negotiations begin, clearly define your objectives. Determine which terms are most important to your business, such as pricing, payment terms, minimum order quantities, lead times, and return policies. Knowing your priorities will help you negotiate more effectively and be willing to compromise on less critical aspects.

Prepare to Offer Something in Return: Negotiation is a two-way street. Be prepared to offer something in return for the concessions you’re seeking. This could include committing to a longer contract term, providing upfront payments, or agreeing to order minimums that ensure profitability for the supplier.

Be Professional and Respectful: Approach negotiations with professionalism and respect. Understanding and respecting Polish business etiquette can go a long way in fostering a positive negotiation atmosphere.

Use Data to Support Your Requests: When negotiating terms, support your requests with data and market research. Demonstrating how specific terms can lead to mutual benefits can make a compelling case for why a supplier should consider your proposals.

Explore Creative Solutions: If you encounter resistance to your requests, be open to exploring creative solutions that meet both parties’ needs. This could involve phased adjustments to terms, shared marketing efforts, or other collaborative strategies that can enhance the partnership’s value.

Negotiate Payment Terms: Payment terms are often a key area for negotiation. Aim for terms that improve your cash flow, such as extended payment periods or discounts for early payments. Suppliers may be open to these terms if they see the potential for consistent and growing order volumes.

Discuss Minimum Order Quantities (MOQs): MOQs can be a significant barrier for new or small dropshipping businesses. Negotiate lower MOQs to reduce your risk and inventory costs, especially when testing new products in the market.

Seek Win-Win Outcomes: Aim for agreements that offer mutual benefits. Suppliers are more likely to agree to terms that also support their business goals, such as securing long-term business or expanding their market presence.

Document Agreements: Once you reach an agreement, ensure all terms are clearly documented in a contract. This contract should cover pricing, payment terms, delivery schedules, MOQs, return policies, and any other agreed-upon conditions. Clear documentation prevents future misunderstandings and provides a foundation for resolving disputes.

Review and Adjust as Needed: The business landscape is dynamic, and your dropshipping needs may evolve. Establish a process for regular reviews of the terms with your suppliers to ensure they continue to meet your business needs. This ongoing dialogue can lead to further optimizations and strengthen the partnership over time.

Negotiating with suppliers from Poland requires a strategic approach that balances assertiveness with respect and collaboration. By thoroughly preparing, building strong relationships, and focusing on mutual benefits, dropshipping businesses can secure terms that support their growth and profitability. Remember, the goal is to create a sustainable partnership that benefits both your business and your Polish suppliers, laying the groundwork for long-term success.

When venturing into dropshipping from Poland, it’s crucial to navigate the legal landscape carefully to ensure compliance and safeguard your business against potential legal issues. Poland, being part of the European Union (EU), adheres to EU regulations alongside its national laws, which can impact various aspects of your dropshipping operation. Here’s an overview of key legal considerations to keep in mind:

E-Commerce Regulations: Familiarize yourself with the EU’s Directive on Electronic Commerce, which outlines requirements for online businesses, including information that must be provided to consumers before and after making a purchase. Ensure your dropshipping store complies with these requirements, such as displaying clear product descriptions, pricing, and the company’s contact information.

Consumer Protection Laws: The EU Consumer Rights Directive offers extensive protection to consumers, including the right to a 14-day withdrawal period (right of return), clear information on delivery times, and total costs. Your policies must align with these regulations to avoid legal penalties and foster trust with your customers.

Value-Added Tax (VAT): Selling goods in the EU involves navigating VAT regulations. Since January 1, 2021, the EU has implemented new VAT rules for e-commerce sales. Understand how to apply VAT on your products, including registering for VAT in Poland or in other EU countries if your sales exceed certain thresholds. Utilize the One-Stop Shop (OSS) scheme to simplify VAT obligations for cross-border sales within the EU.

Customs Duties: For goods imported from outside the EU and sold to customers within the EU, customs duties may apply depending on the product type and value. Ensure you understand these obligations and who bears the responsibility for customs fees – your business or your customers.

General Data Protection Regulation (GDPR): The GDPR imposes strict rules on the handling of personal data of EU citizens. Ensure your dropshipping store complies with GDPR requirements, such as obtaining consent for data processing, providing clear privacy policies, and implementing adequate data security measures.

Trademark and Copyright Laws: Ensure the products you sell do not infringe on intellectual property rights. This includes avoiding counterfeit goods and ensuring that any branded products are sourced from authorized suppliers. Violations can lead to legal disputes and significant penalties.

EU Product Safety Regulations: Products sold in the EU must meet specific safety standards and requirements. Familiarize yourself with relevant regulations, such as CE markings for certain product categories, to ensure the products you dropship from Poland comply with EU standards.

Product Liability: Under EU law, retailers are responsible for the safety of the products they sell. Ensure your suppliers in Poland adhere to EU product safety standards to mitigate the risk of liability for defective or unsafe products.

Supplier Contracts: Establish clear contractual agreements with your suppliers in Poland. These contracts should outline terms of supply, product quality specifications, compliance with legal standards, and liability clauses. A well-drafted contract can provide legal protection and clarify responsibilities between your business and your suppliers.

Regulated Products: If you plan to sell products that fall under specific regulations (such as cosmetics, food supplements, or electronics), ensure you comply with all relevant EU and Polish regulations regarding labeling, safety, and product composition.

Navigating the legal landscape requires diligence and, often, professional legal advice. Consider consulting with a legal expert specializing in EU and Polish e-commerce law to ensure your dropshipping business complies with all relevant regulations. Staying informed and compliant not only protects your business from legal risks but also builds trust with your customers, contributing to the long-term success of your dropshipping venture.

Ensuring product quality when choosing suppliers from Poland for your dropshipping business is paramount to building a reputable brand and sustaining customer satisfaction. High-quality products reduce returns, enhance customer loyalty, and foster positive reviews, which are crucial for the success of any e-commerce venture. Here’s a comprehensive approach to guaranteeing product quality with Polish suppliers:

Identify Reputable Suppliers: Start by identifying suppliers known for their quality products. Utilize online directories, trade shows, and industry forums specific to Poland to find suppliers with positive reviews and testimonials.

Evaluate Supplier History and Reputation: Research the supplier’s history, reputation in the market, and previous collaborations. Suppliers with a long-standing presence and a solid track record are more likely to provide reliable product quality.

Sample Evaluation: Before committing to any supplier, request samples of the products you plan to dropship. Assess the quality of these samples in terms of materials, craftsmanship, functionality, and any other criteria important to your niche.

Compare Multiple Suppliers: Obtain samples from several suppliers to compare quality. This comparative analysis will help you make an informed decision about which suppliers meet your standards.

Inquire About Quality Assurance Measures: Ask potential suppliers about their quality control (QC) processes. Reliable suppliers should have comprehensive QC measures in place at various stages of production, from sourcing raw materials to final assembly.

Certifications and Standards Compliance: Look for suppliers that adhere to international and European Union standards, such as ISO certifications. Compliance with these standards is a strong indicator of a supplier’s commitment to quality.

Define Quality Specifications: Clearly define your quality requirements in a document or contract. This agreement should outline your expectations regarding product specifications, packaging, and quality standards.

Agreement on Quality Control Documentation: Agree with suppliers on providing quality control reports and documentation for each batch of products. This documentation should detail the QC measures taken and the results of those tests.

Regular Communication: Maintain open and regular communication with your suppliers. This ensures any quality issues can be promptly addressed and resolved.

Feedback Loop: Create a feedback loop where you can relay customer feedback and quality issues back to the supplier. This continuous improvement process helps in maintaining high-quality standards.

Conduct Regular Audits: If possible, plan for regular quality audits of the supplier’s facilities. Personal visits or third-party audits can provide insights into the production processes, worker conditions, and the overall quality management system.

Remote Audits: For dropshippers unable to conduct in-person audits, consider remote audit options. Video tours and virtual meetings can offer transparency into the supplier’s operations and quality control practices.

Track Customer Reviews: Closely monitor customer feedback and reviews related to product quality. This real-time data can provide valuable insights into any recurring issues or quality declines.

Responsive Action Plan: Implement a responsive action plan to address any quality issues identified through customer feedback. Promptly communicating these issues to your supplier is essential for quick resolution and continuous quality improvement.

Ensuring product quality when sourcing from suppliers in Poland involves diligent research, clear communication of expectations, and ongoing monitoring. By establishing a robust quality assurance framework and building a strong partnership with your suppliers, you can significantly reduce the risk of quality issues and build a dropshipping business that stands out for its commitment to excellence. Remember, the quality of your products directly reflects on your brand, making it crucial to prioritize and invest in quality assurance from the outset.

Marketing products sourced from Poland effectively involves leveraging the unique qualities of Polish goods, understanding your target market, and utilizing a mix of traditional and digital marketing strategies to highlight the value and appeal of your offerings. Given the increasing globalization and the specific advantages of Polish products, such as high-quality craftsmanship, unique designs, and competitive pricing, here are strategic approaches to market these products successfully:

Highlight Quality and Craftsmanship: Polish products often stand out for their quality and craftsmanship. Emphasize these attributes in your marketing materials, showcasing the attention to detail and superior standards that Polish suppliers adhere to.

Promote Unique Designs and Products: Many products from Poland come with unique designs and cultural significance. Highlight these aspects to differentiate your products from competitors and appeal to consumers looking for something unique and authentic.

Utilize Visual Platforms: Platforms like Instagram, Pinterest, and Facebook are ideal for showcasing the aesthetic appeal and quality of your products. Use high-quality images and videos to tell a visual story that resonates with your audience.

Engage with Influencers: Collaborate with influencers who align with your brand values and audience. Influencers can help introduce your Polish-sourced products to a broader audience, leveraging their trust and credibility to enhance your brand’s visibility.

Educational Content: Create content that educates your audience about the benefits of the products you’re offering, the history and tradition behind them, or how they’re made. Blogs, videos, and infographics can help tell the story behind your products, adding value and building interest.

Customer Stories and Testimonials: Share customer stories and testimonials that highlight the positive experiences and satisfaction with your products. Authentic user experiences can significantly influence potential customers’ buying decisions.

Optimize for Relevant Keywords: Use SEO strategies to ensure your website and product pages rank high in search engine results for keywords related to Polish products and their unique attributes. Keyword research tools can help you identify the terms your target audience is searching for.

Localize Content: If targeting specific markets, consider localizing your content to resonate with those audiences. This includes translating your website and using local keywords to improve search visibility in targeted regions.

Segmented Email Campaigns: Use email marketing to keep your subscribers informed about new products, special offers, and stories about your Polish suppliers. Segmenting your email list based on customer interests and behavior can increase the relevance and effectiveness of your campaigns.

Exclusive Offers: Provide exclusive offers or early access to new products for your email subscribers, creating a sense of exclusivity and loyalty among your customer base.

Collaborate with Polish Cultural Organizations: Partner with Polish cultural organizations or communities in your target markets. These partnerships can help you tap into an audience already interested in Polish culture and products, providing a platform for promotions and events.

Cross-Promotions with Complementary Brands: Identify and collaborate with brands that offer complementary products or share a similar target audience. Cross-promotions can expand your reach and introduce your products to a broader audience.

Expand Your Presence: Beyond your e-commerce store, consider selling your products on popular online marketplaces. Platforms like Etsy, Amazon, or eBay can provide additional visibility, especially if they have dedicated sections for artisanal or international products.

Effectively marketing products sourced from Poland requires a strategic approach that capitalizes on their unique qualities, leverages digital marketing tools, and engages with your target audience through compelling storytelling and education. By emphasizing the unique selling propositions of Polish products, utilizing a mix of marketing channels, and building meaningful connections with your audience, you can create a distinctive brand presence and drive sales for your dropshipping business.

Automating the dropshipping process with suppliers from Poland is essential for maximizing efficiency, minimizing errors, and scaling your business. Automation can streamline operations, from order processing to inventory management, allowing you to focus on growth and customer service. Here’s how to effectively automate your dropshipping business with Polish suppliers:

Choose the Right Software: Select dropshipping automation software that integrates seamlessly with your e-commerce platform and Polish suppliers’ systems. Look for features like real-time inventory updates, automatic order forwarding, and tracking information updates.

Integration with Suppliers: Ensure the software can directly integrate with your Polish suppliers’ systems for smooth communication of orders and inventory levels. This direct integration reduces the risk of overselling and keeps your product listings up to date.

Electronic Data Interchange (EDI): Set up an EDI connection with your suppliers in Poland. EDI allows for the electronic exchange of business documents, such as purchase orders and invoices, directly between your business systems and those of your suppliers, enabling faster processing and fewer manual errors.

Custom EDI Solutions: If your suppliers already have EDI capabilities, work with them to establish a direct connection. If not, consider using third-party EDI providers that can facilitate this integration on behalf of your suppliers.

Real-time Inventory Tracking: Use inventory management tools that offer real-time tracking of stock levels at your suppliers’ warehouses. This ensures your website reflects accurate stock information, preventing customer disappointment and order cancellations.

Automated Reordering: Set up automated reordering thresholds within your inventory management system. When stock levels for a particular product fall below a predetermined level, the system can automatically place a reorder with your Polish supplier, ensuring you never run out of popular items.

Automated Order Routing: Configure your system to automatically route orders to the appropriate Polish supplier based on factors like product availability, geographic location, and shipping costs. This optimization ensures the fastest and most cost-effective fulfillment.

Order Confirmation and Tracking: Automate the confirmation of orders with suppliers and the generation of tracking numbers for customers. This step keeps customers informed about their order status, enhancing their shopping experience.

Automated Customer Communications: Implement automated email or SMS notifications to update customers on their order status, from confirmation to shipment and delivery. Personalize these communications to enhance customer engagement and satisfaction.

FAQs and Chatbots: Use automated chatbots and a comprehensive FAQ section on your website to address common customer inquiries. This can significantly reduce the volume of customer service requests and improve response times for more complex issues.

Performance Analytics: Utilize analytics tools to monitor the performance of your automated processes. Analyze data on order processing times, shipping efficiency, and customer satisfaction to identify areas for improvement.

Feedback Loops: Establish feedback loops with your Polish suppliers and customers to gather insights on the effectiveness of your automation strategies. Use this feedback to make continuous adjustments and enhancements.

Automating the dropshipping process with suppliers from Poland requires strategic investment in technology and a commitment to ongoing optimization. By leveraging automation software, EDI connections, inventory management tools, and efficient order processing systems, you can create a streamlined, efficient dropshipping operation. This not only enhances your operational efficiency but also improves the customer experience, setting your business up for long-term success and scalability.

Understanding the typical shipping costs and times when dropshipping from Poland to other countries is crucial for managing expectations, setting customer shipping policies, and ensuring the competitiveness of your e-commerce store. Shipping costs and delivery times can vary significantly based on several factors, including the destination country, the size and weight of the package, the shipping service chosen, and the specific policies of your Polish suppliers. Here’s an overview to guide you through this aspect of dropshipping:

Destination Country: Shipping costs and times vary widely depending on the destination. Shipping within the European Union is generally faster and less expensive due to Poland’s central location and EU trade agreements. Shipping to countries outside the EU may incur additional costs and longer delivery times due to customs processing.

Package Size and Weight: The size and weight of the package significantly affect shipping costs. Larger and heavier items cost more to ship. It’s essential to factor this into the product selection process and pricing strategy.

Shipping Service: Various shipping services offer different balances of cost and speed. Economy shipping options are less expensive but slower, while express services offer faster delivery at a higher cost. Choosing the right service depends on your customers’ expectations and your profit margins.

Supplier Shipping Policies: Some suppliers may have negotiated rates with shipping carriers or offer subsidies for shipping costs. Understanding your suppliers’ policies can help you manage costs effectively.

Negotiate with Suppliers: Work with your Polish suppliers to negotiate better shipping rates or to find the most cost-effective shipping solutions. Suppliers may offer discounts for bulk shipments or preferred rates with certain carriers.

Choose Products Wisely: Consider the size, weight, and shipping costs when selecting products to dropship. Opting for lighter and smaller items can reduce shipping costs and improve your profit margins.

Transparent Communication with Customers: Clearly communicate shipping costs and expected delivery times to customers at the point of sale. Consider offering free shipping thresholds or flat-rate shipping to simplify the process for customers.

Monitor and Adjust Policies: Regularly review your shipping costs and delivery times. Stay updated with any changes in shipping rates or policies from your suppliers and adjust your shipping policies accordingly to maintain competitiveness and profitability.

While shipping costs and times when dropshipping from Poland to other countries can vary, understanding these factors and planning accordingly is key to a successful dropshipping business. By negotiating with suppliers, selecting products strategically, communicating transparently with customers, and continuously monitoring and adjusting your shipping policies, you can manage shipping costs effectively and ensure timely deliveries, enhancing customer satisfaction and supporting your business growth.

Handling returns and refunds efficiently is a critical aspect of managing a dropshipping business, especially when partnering with suppliers from Poland. The process can seem daunting due to the geographical distance and the involvement of a third party in your supply chain. However, with a clear strategy and open communication, you can navigate these challenges effectively, ensuring customer satisfaction while maintaining a healthy relationship with your suppliers. Here’s a structured approach to managing returns and refunds in your dropshipping business:

Understand Supplier Policies: Before you start selling, understand your Polish suppliers’ return and refund policies thoroughly. This includes the conditions under which items can be returned, the return process, who bears the shipping costs, restocking fees, and the timeframe for processing returns and issuing refunds.

Negotiate Terms: If possible, negotiate these terms to align with your customer service standards. For example, you might work out arrangements for handling defective products or negotiate better return conditions for your customers.

Create Clear Policies for Customers: Based on your agreements with suppliers, establish clear, fair, and transparent return and refund policies for your customers. These policies should detail how and within what timeframe customers can return products, who pays for return shipping, and how refunds or exchanges will be handled.

Communicate Policies Clearly: Make sure your return policies are easy to find and understand on your website. Clear communication prevents misunderstandings and sets the right expectations with your customers.

Simplify the Process for Customers: Provide a straightforward process for customers to initiate returns. This could include an online form on your website, clear instructions via email, or a customer service hotline.

Coordinate with Suppliers: Once a return is initiated, coordinate with your Polish supplier to manage the logistics of the return. Depending on your agreement, the product might be returned directly to the supplier, or you might need to handle the return logistics yourself.

Process Refunds and Exchanges Quickly: After the return is confirmed and inspected by your supplier, process refunds or exchanges promptly. Quick resolution enhances customer trust and satisfaction.

Stay in Communication with Customers: Keep customers informed throughout the process. Notify them when the return is received, when the refund is processed, or when the replacement product is shipped.

Monitor Return Reasons: Keep track of the reasons for returns and identify any patterns. This could indicate issues with product quality, descriptions, or customer expectations that need to be addressed.

Work with Suppliers to Improve Quality: If returns are frequent due to product quality, discuss these issues with your suppliers. Work together to find solutions or consider changing suppliers if necessary.

Feedback Loop: Treat returns as an opportunity to improve your product offerings and customer service. Use the feedback from the return process to enhance your store’s operations and reduce future returns.

Build Customer Loyalty: Handling returns efficiently and fairly can turn a potentially negative experience into a positive one, building customer loyalty and encouraging repeat business.

Managing returns and refunds when dropshipping with suppliers from Poland requires careful planning, clear communication, and a customer-centric approach. By establishing clear policies, simplifying the return process, and maintaining open lines of communication with both suppliers and customers, you can effectively manage returns and refunds. This not only ensures customer satisfaction but also strengthens your brand’s reputation, contributing to the long-term success of your dropshipping business. Remember, the goal is to create a seamless experience for your customers while minimizing the impact of returns on your operations.

Ensuring fast and reliable shipping when working with suppliers from Poland is pivotal for the success of your dropshipping business. Fast and reliable shipping not only enhances customer satisfaction but also strengthens your brand’s reputation, leading to repeat business and positive reviews. Here are strategic steps you can take to ensure your shipping meets these standards:

Evaluate Shipping Capabilities: Select suppliers with a proven track record of fast and reliable shipping. Consider their logistics infrastructure, carrier partnerships, and shipping technology.

Test Shipping Times: Before finalizing partnerships, test the shipping times of potential suppliers by ordering samples. This will give you a real-life understanding of their shipping efficiency.

Centralized Warehousing: Work with suppliers that have centralized warehousing in Poland. Central locations can significantly reduce transit times within Europe.

Stock Levels Management: Collaborate with your suppliers to ensure they maintain adequate stock levels of your best-selling products. This prevents delays that occur when items are out of stock.

Automated Order Processing: Utilize dropshipping and e-commerce platforms that can automate order processing. Direct integration between your sales platform and the supplier’s system can speed up order handling.

Real-time Tracking: Choose suppliers that offer real-time tracking for shipments. This allows you and your customers to monitor the progress of orders, enhancing trust and transparency.

Diversify Carriers: Don’t rely on a single carrier. Use multiple shipping services to find the fastest and most cost-effective options for different regions.

Offer Expedited Shipping: For customers willing to pay more for speed, offer expedited shipping options. Ensure your suppliers can support these faster services.

Set Expectations: Clearly communicate your shipping expectations with your suppliers. Establish agreed-upon benchmarks for shipping times and handling periods.

Regular Reviews: Conduct regular performance reviews with your suppliers to discuss shipping efficiency and address any issues promptly.

Transparent Shipping Policies: Be transparent about shipping times on your website. Clearly state estimated delivery times for different regions to manage customer expectations.

Update Customers Proactively: If any delays occur, update customers proactively. Good communication can mitigate dissatisfaction with shipping delays.

Pre-shipment Inspections: Arrange for pre-shipment inspections to ensure orders are correctly fulfilled before leaving the warehouse. This can reduce errors and delays caused by returns or exchanges.

Feedback Loop: Create a feedback loop with your customers to gather insights on the shipping experience. Use this feedback to continuously improve your shipping processes.

Anticipate Demand: Work with your suppliers to anticipate periods of high demand, such as holidays or sales seasons. Planning ahead can help manage inventory and ensure timely shipping during these peak times.

Adjust Shipping Estimates: Adjust your shipping estimates during peak seasons to account for increased demand on carriers and possible delays.

Fast and reliable shipping is a cornerstone of customer satisfaction in dropshipping. By carefully selecting and communicating with suppliers from Poland, leveraging technology, diversifying shipping options, and managing customer expectations, you can provide an exceptional shipping experience. Remember, the goal is to build a resilient and efficient shipping strategy that supports your business growth and keeps your customers coming back.

Dropshipping to customers outside of Europe using suppliers from Poland is entirely feasible and can be a strategic move to expand your business globally. However, this approach comes with its own set of implications and considerations that you need to manage effectively. Understanding these can help you navigate the challenges and capitalize on the opportunities of serving a global customer base. Here’s an in-depth look at the implications and how to address them:

Extended Shipping Times: Shipping from Poland to countries outside of Europe generally involves longer transit times. It’s crucial to manage customer expectations by clearly communicating these extended delivery periods.

Higher Shipping Costs: The cost of shipping internationally from Poland can be significantly higher than within Europe. These costs need to be factored into your pricing strategy without compromising competitiveness.

Customs Regulations: Each country has its own customs regulations and requirements. You and your customers might face additional paperwork and compliance checks, which can add complexity and potential delays.

Duties and Taxes: Products shipped from Poland to non-European countries may be subject to import duties and taxes, which can increase the total cost to the customer. Transparently communicate about these potential extra charges or incorporate them into your pricing strategy.

International Trade Laws: Familiarize yourself with the international trade laws that apply to exporting goods from Poland to your target countries. Compliance with these laws is essential to avoid legal issues.

Product Regulations: Ensure that the products you’re dropshipping comply with the regulatory standards of the destination countries. Non-compliance can result in products being seized by customs, leading to customer dissatisfaction and financial losses.

Currency Fluctuations: Dealing with multiple currencies can expose your business to currency exchange risks. Prices and profit margins can fluctuate based on exchange rates, affecting your overall profitability.

Payment Methods: Offering payment methods that are popular and trusted in your customers’ countries can improve conversion rates. Ensure your payment processor can handle transactions in different currencies and from various regions.

Language Barriers: Serving customers outside of Europe may require offering customer support in their local languages. Consider the cost and logistics of providing multilingual support.

Handling Returns: Managing returns from international customers can be more complicated and costly. Develop a clear return policy that balances customer satisfaction with the feasibility of international returns.

Market Research: Understanding the cultural nuances, preferences, and buying behaviors of customers in different countries can help you tailor your marketing and product selection to better meet their needs.

Localized Marketing: Implement localized marketing strategies that resonate with your target audiences. Cultural sensitivity and relevance can significantly impact your brand’s appeal and success in foreign markets.

Dropshipping to customers outside of Europe using suppliers from Poland offers a valuable opportunity to scale your business internationally. However, it requires careful planning and execution to navigate the logistical, regulatory, and cultural challenges involved. By addressing these implications head-on — through transparent communication, strategic planning, and localized approaches — you can successfully expand your dropshipping business to a global audience while maintaining customer satisfaction and compliance with international trade practices.

Dropshipping from Poland offers a lucrative opportunity for e-commerce entrepreneurs, given the country’s strategic location, advanced manufacturing sector, and robust infrastructure. However, like any business model, it comes with its set of challenges. Understanding these obstacles and strategizing effectively to overcome them can pave the way for a successful dropshipping business. Here are some common challenges faced when dropshipping from Poland and strategies to mitigate them:

Challenge: While Poland is ideally located for shipping within Europe, delivering to customers outside of Europe can be costly and time-consuming. International shipping can significantly affect your competitiveness and customer satisfaction.

Solution: To overcome this, negotiate better shipping rates with your suppliers or logistics providers. Consider using courier services that offer competitive rates for international shipping. Additionally, clearly communicate shipping times and costs to customers to manage their expectations effectively.

Challenge: Engaging with suppliers from Poland may present language barriers and cultural differences, potentially complicating communication and business negotiations.

Solution: Employ translation services or hire team members fluent in Polish to facilitate communication. Understanding and respecting Polish business culture can also enhance your relationship with suppliers. Engaging in local trade shows or business networks can provide insights and help bridge cultural gaps.

Challenge: The European Union has stringent regulations on product standards, safety, and compliance. Navigating these regulations can be daunting, especially for new entrants unfamiliar with the EU market.

Solution: Invest time in understanding EU regulations relevant to your products. Work with legal advisors or compliance experts to ensure your products and business practices meet all necessary EU standards. Partnering with Polish suppliers well-versed in EU regulations can also streamline compliance.

Challenge: Ensuring consistent product quality can be challenging when you’re not physically present to inspect goods. Poor quality products can harm your brand reputation and customer satisfaction.

Solution: Request samples before committing to large orders and conduct regular quality checks. Consider using third-party inspection services to conduct pre-shipment inspections. Establish clear quality standards with your suppliers and work closely with them to ensure these standards are met.

Challenge: Keeping track of inventory levels can be complex, especially when working with multiple suppliers. Stockouts or overstocking can lead to lost sales or increased carrying costs.

Solution: Implement an inventory management system that offers real-time visibility into stock levels at your suppliers’ warehouses. Automate inventory updates to your e-commerce platform to reflect current availability accurately.

Challenge: When dropshipping to customers outside the EU, customs and duties can complicate the shipping process and increase costs for customers, potentially affecting sales.

Solution: Clearly inform customers about potential customs fees and duties they may incur on international orders. Explore the possibility of using delivery duty paid (DDP) shipping options where taxes and duties are pre-paid, simplifying the process for your customers.

Challenge: The e-commerce landscape is dynamic, with consumer preferences and market trends constantly evolving. Staying ahead of these trends can be challenging, especially when sourcing from overseas suppliers.

Solution: Regularly research market trends and consumer preferences. Work closely with your Polish suppliers to quickly adapt your product offerings to meet changing demands. Consider leveraging social media and analytics tools to gain insights into consumer behavior.

Dropshipping from Poland presents unique challenges, but with careful planning, strategic partnerships, and effective use of technology, these challenges can be overcome. By addressing issues related to shipping, compliance, product quality, inventory management, and market adaptation, you can build a resilient and successful dropshipping business that leverages the strengths of Polish suppliers while meeting the demands of a global customer base.

Building a scalable dropshipping business model with suppliers from Poland requires strategic planning, effective management, and a focus on long-term growth. Poland, with its strategic location in Europe, advanced manufacturing capabilities, and competitive pricing, offers a solid foundation for scaling a dropshipping business. Here’s how you can leverage these advantages to create a scalable and sustainable business model:

Building a scalable dropshipping business with suppliers from Poland is about more than just increasing sales; it’s about creating a flexible, efficient, and resilient business model that can adapt and thrive in the dynamic e-commerce landscape. By focusing on strong supplier relationships, operational efficiency, market expansion, and sustainable practices, you can set the foundation for a successful and scalable dropshipping business.

Enter your email below to get news about the latest shipping lists and interesting insights.